Article

Nanny vs Au Pair vs Babysitter

Nanny vs Au Pair vs Babysitter: What’s the Difference (and Who Needs to Be on Payroll?)

Hiring help to care for your children is a big decision. But in New Zealand, it’s also one that comes with legal and financial responsibilities, especially when it comes to paying tax, KiwiSaver, and complying with employment law.

Whether you’ve found someone through a friend, a platform like Caresies, or a formal agency, understanding the difference between a nanny, an au pair, and a babysitter is essential to making sure you’re meeting your obligations.

Let’s break it down.

What is a Nanny?

A nanny is a paid childcare worker who provides regular, often daily, in-home care. Nannies may be full-time or part-time and are usually employed directly by the family.

Common characteristics:

- Works fixed or regular hours (e.g. 8am–5pm)

- Provides structured care including meals, learning activities, and outings

- Often has childcare qualifications or prior experience

- May assist with household duties like laundry or meal prep

Do you need to put your nanny on payroll?

Yes. In New Zealand, a nanny is an employee, not a contractor. That means you need to:

- Register as an employer with IRD or sign up with a service like Pay The Nanny

- Pay income tax, KiwiSaver contributions, ACC and annual leave entitlements

- Provide payslips and keep employment records

This is where services like Pay The Nanny make things easy by handling payroll, tax filings, and compliance for you. They can also help with providing an employment contract template for your nanny.

What is an Au Pair?

An au pair is typically a young person (often from overseas) who lives with your family in exchange for childcare support, cultural exchange, and a weekly allowance (called a stipend or pocket money allowance).

Common characteristics:

- Lives in your home (room and board provided)

- Works between 20 – 45 hours per week

- Receives a weekly allowance (e.g. $200–$425/week)

- Usually here on a Working Holiday Visa

Do you need to put your au pair on payroll?

Yes, usually. It’s a common misconception that because your au pair is on a cultural exchange, they don’t need to be on the payroll.

According to IRD guidance, if your au pair performs work duties and receives regular payments, they’re likely to be an employee, not a volunteer.

You’ll need to:

- Deduct PAYE tax

- Pay KiwiSaver (if eligible)

- Meet minimum wage and leave requirements

It might seem a grey area but in almost all real-world scenarios, au pairs should be treated as employees under NZ law.

What is a Babysitter?

A babysitter is someone who looks after your children on an occasional or casual basis typically in the evenings or weekends. They are usually hired informally on an ad-hoc basis.

Common characteristics:

- Works irregular hours (e.g. date nights, emergencies)

- No formal qualifications required

- Paid per hour or per job

- Not involved in long-term childcare arrangements

Do you need to put your babysitter on payroll?

Probably not. If you’re hiring someone casually, for fewer than say 10 hours/month, and they’re setting their own availability and rate, they may be treated as a self-employed contractor.

That said, if a babysitter works regular hours or becomes a core part of your childcare routine, they may legally be considered an employee.

As Employment NZ notes, “it’s not about what the agreement says - it’s about the real nature of the relationship.”

If you are unsure, get in touch with our team and we’ll happily help out.

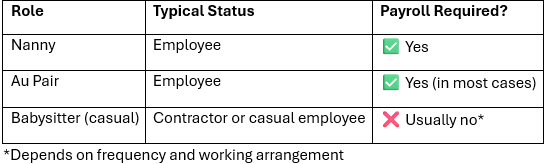

So Who Actually Needs to Be on Payroll?

How Pay The Nanny Can Help

If you're not sure how to classify your carer or want to make sure you're meeting your legal obligations, Pay The Nanny makes it simple. We:

- Handle tax, KiwiSaver and leave calculations

- Provide payslips and summaries for your records

- Keep you fully compliant with IRD and Employment rules

- Support both regular and short-term nanny arrangements

Peace of mind for you. Fair pay and entitlements for your nanny.

Payroll for Au Pairs | Pay The Nanny

8 Tips for Getting Childcare Sorted in 2022

Benefits of Hiring an Au Pair in New Zealand

Why You Should Hire a Live-in Nanny