Article

Is my Nanny a Contractor or an Employee?

Should Your Nanny be a Contractor or an Employee?

If you hire a nanny, caregiver, or other in-home help, one of the most important questions you need to ask is:

“is my nanny an employee or a contractor?”

In most cases, the answer is an employee. But many families in New Zealand still assume they can be paid as a contractor, sometimes unintentionally, and the consequences can be costly.

In this guide, we’ll explain the difference between an employee and an independent contractor, what the law says, what your obligations are, and how Pay The Nanny can take the stress out of getting it right.

Why the distinction matters

Whether your nanny is an employee or a contractor affects how they’re paid, what entitlements they receive, and what your legal responsibilities are as an employer.

If you misclassify them, even unknowingly, you could be held responsible for unpaid PAYE, leave, KiwiSaver, and more with potential penalties from the IRD or Employment Relations Authority.

The short version? If your nanny:

- Works in your home

- Follows a schedule that you’ve set

- Follows a continuous work pattern

- Can’t set their own rate

- Doesn’t provide the equipment or tools to complete their work

Then, they’re probably an employee.

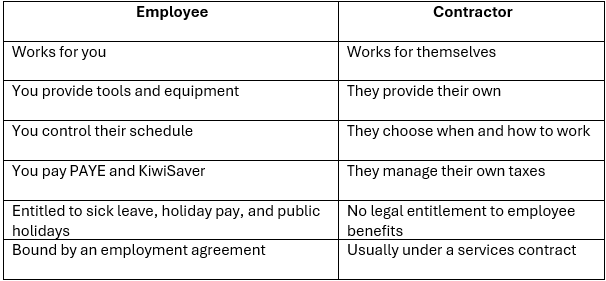

Employee vs Contractor – what’s the legal difference?

Employment New Zealand outlines several key differences and tests between contractors and employees. You can view the official guide here.

Below we’ve outlined the general differences between an employee and contractor:

These guidelines are not just for big companies they apply to all employers in New Zealand. Therefore, they apply equally to households employing nannies, caregivers, or au pairs.

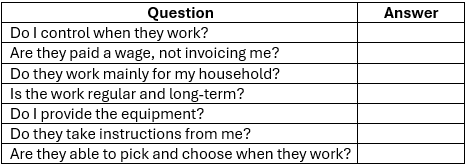

Ask yourself these 6 questions:

Here are six simple questions to help determine whether your nanny is likely an employee:

1. Do you set their working hours?

2. Do they mainly work for your household?

3. Do you tell them what to do and when to do it?

4. Do they use your tools or equipment (car, cot, pram etc.)?

5. Are they paid a regular wage, rather than invoicing you?

6. Is the work ongoing and not a one-off project?

If you answered “yes” to most of these questions, your nanny is almost certainly an employee.

Still not sure? Employment NZ also has detailed legal tests here that can help guide you.

What do I need to do if my nanny is an employee?

If you’re hiring a nanny, then the chances are that you’ll need to employ them, rather than engage them as an independent contractor. If your nanny is classified as an employee, your household becomes their employer. That might sound intimidating but it’s actually not.

We’ve broken down the key steps below around what you need:

1) Have a written employment agreement

This is legally required and must be signed before the nanny starts work. You can use Business.govt.nz’s Employment Agreement Builder to create one for free. If you’re using Pay The Nanny, we can provide a compliant employment agreement at no extra cost too.

2) Pay at least the minimum wage

As of April 2025, the adult minimum wage in New Zealand is $23.50 per hour. Check current rates on the MBIE website.

3) Deduct PAYE and remit it to Inland Revenue

As an employer, you're responsible for tax deductions including PAYE, ACC, and KiwiSaver if they’ve opted in.

Learn more about your tax obligations here.

4) Keep accurate records

This includes timesheets, pay records, leave balances, and more. You must issue a payslip with every pay.

5) Provide leave entitlements

Employees are entitled to annual leave, sick leave, bereavement leave, and public holidays. If they are a casual employee, it’s a little different and if you’re unsure, you can always reach out to the team and we’ll be happy to help.

See full details here.

6) Confirm your nanny’s right to work

You’re legally required to confirm that your nanny can work in New Zealand.

Check visa and work eligibility here. Our team can also help with some of the pre-employment checks for your nanny too.

Common mistakes and their risks

Some families try to simplify things by hiring their nanny as a “contractor” or paying cash. But if IRD or MBIE determine that the nanny is really an employee, the consequences can include:

- Unpaid PAYE tax (which the employer is liable for)

- Backdated holiday pay and leave entitlements

- Fines or penalties for non-compliance

- Interest charges from IRD

- Personal grievances from the nanny

Even if the mistake was unintentional, the penalties still apply. Whilst it might seem an easier to solution to hire the nanny as a contractor, it can sometimes find families unstuck down the track.

Why getting it right matters for both Nanny and Employer

Getting it right protects both the employer and the nanny and it’s also the right thing to do.

By getting the classification correct for your nanny, it means:

- Your nanny has a clear agreement, legal protections, and stable income.

- You stay compliant, avoid penalties, and enjoy peace of mind.

- If something goes wrong (like a dispute or audit), you're covered with documentation and records.

It’s also a show of respect and recognition of the work they undertake. Treating your nanny as an employee, when they legally are one, shows that you value their role in your family life.

Final checklist: Is your nanny an employee?

If you ticked most of these, you’ve got an employee.

How Pay The Nanny helps

At Pay The Nanny, we make nanny payroll simple, compliant, and stress-free for families across New Zealand.

Here’s what we take care of:

- Payroll setup & IRD registration

- Providing compliant employment agreement templates

- Calculating PAYE, KiwiSaver, and leave calculations

- Managing all IRD filings and payments

- Secure online timesheets and payslips

- Support with leave, terminations, and changes in hours

- Generalised HR support

We work with families of all shapes, sizes for domestic caregivers. Whether you’ve got a full-time nanny, a part-time carer, or someone helping casually during school holidays, we’re able to help.

Need help?

If you’re unsure about how to pay your nanny or whether your confused about whether they are an employee or contractor, don’t worry! We’ve helped thousands of Kiwi families get it right every year.

Visit www.paythenanny.co.nz or reach out to our team and get in touch.

Employing a Nanny in 2022

When Are Nannies Employees and What Does It Mean for Parents?

Payroll for Au Pairs | Pay The Nanny

Money-Saving Tips to Afford a Nanny