Article

2025 Au Pair Rates and Hiring Guide

2025 Guide to Hiring and Paying an Au Pair in New Zealand

Last updated 19th May 2025

Bringing an au pair into your home can be an enriching experience offering not only flexible, live-in childcare but also a meaningful cultural exchange for your family. But when it comes to payroll, many Kiwi families find the rules and responsibilities a bit confusing.

Whether it’s your first time hosting an au pair or you're simply looking to stay compliant, this guide walks you through everything you need to know about au pair payroll in New Zealand for 2025—from legal requirements to setting fair pay, and managing deductions like board and lodgings.

What is an Au Pair and How Do They Differ from a Nanny?

An au pair is typically a young person from overseas who lives with a host family and helps with childcare and light housework in exchange for accommodation, meals, and weekly wages (often called “pocket money”).

In New Zealand, the legal treatment of an au pair is the same as any other employee including nannies. This means:

- Au pairs must be paid at least the minimum wage

- They are entitled to sick leave, annual leave, and public holidays

- They require a formal, signed employment agreement

- Families must handle tax, ACC levies, and potentially KiwiSaver

The main difference? An au pair lives with your family, so part of their compensation includes a board and lodgings deduction, which we’ll explain in detail shortly.

Setting Up Payroll for an Au Pair

There are two ways to set up payroll:

Option 1: Use a Nanny Payroll Service like Pay The Nanny

This is by far the simplest option.

- You don’t need to register with the IRD - we take care of that.

- We process all tax, ACC, and KiwiSaver (if applicable) obligations.

- You remain the legal employer, but we manage everything in the background.

Option 2: Do it Yourself via IRD

If you prefer the DIY route, here’s how to register as an employer:

- Gather your details (name, address, bank account, etc.)

- Log into or create a MyIR account

- Go to “I want to...” > “Register for new tax accounts”

- Follow the prompts to register as an employer

Understanding Your Tax Obligations

Employing an au pair comes with a few key responsibilities:

- PAYE: Deduct tax from wages using IRD tax codes

- ACC Levies: You must pay both employee (via employee’s PAYE) and employer ACC contributions

- KiwiSaver: Most au pairs aren’t eligible, but if they are, you’ll need to contribute 3%

If you're using Pay The Nanny, we handle all of this for you automatically.

Why You Need a Formal Employment Contract

An au pair cannot be paid cash under the table.

Legally, they must:

- Be employed on a signed employment agreement

- Be paid through payroll with tax and leave entitlements

- Have any deductions (like board and lodgings) agreed in writing

If your au pair is staying for a set time, use a fixed-term contract. Also, include details like:

- Board & Lodgings deduction amount (must be post-tax and consented to)

- Completion bonus (if applicable)

- Hours of work and duties

We can provide a compliant contract template, just ask our team.

How Much to Pay an Au Pair | 2025

For a more detailed breakdown, get in touch with our team.

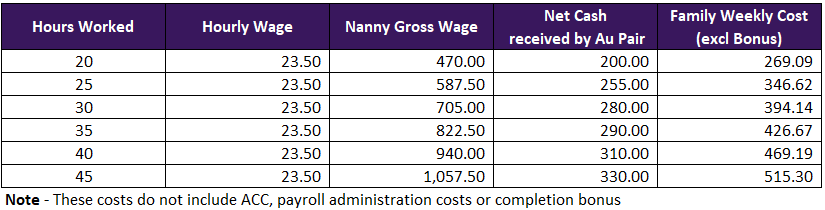

Standard Au Pair

- Some childcare experience

- $200 – $330 net per week (20–45 hours

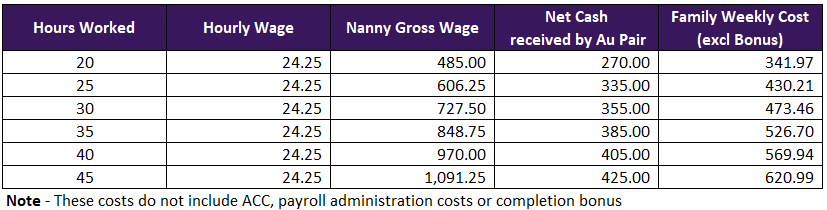

Expert Au Pair

- More experience or formal ECE qualifications

- $310–$450 net per week (20–45 hours

These rates are industry benchmarks used by leading au pair agencies but it’s important to note that these are guidelines only and employers and employees should always agree to make sure things align with expectations.

What is Board and Lodgings?

Board and lodgings is a fixed weekly deduction from your au pair’s gross pay to account for the accommodation and meals you provide.

It must be:

- Fixed: The same amount each pay cycle

- In writing: Included in the signed employment contract

- Fair: It shouldn’t reduce take-home pay to unsustainable levels

Common Payroll Mistakes:

- Deducting too much (leading to underpayment)

- Changing the amount frequently

- Not including it in the contract

Tips:

- Set a fair amount using industry guidelines

- Keep it consistent each week

- Don’t over-deduct your au pair still needs a liveable income

- If unsure, ask us or your placement agency

How to Find an Au Pair in New Zealand

There are three popular methods:

1. Au Pair Link (Agency Option)

A full-service agency that handles recruitment, contracts, and visa support.

- Visit their website to create a profile

- Get matched with pre-screened au pairs

- Interview, choose, and they handle the rest

2. Au Pair World (DIY Option)

An international platform where you manage the process yourself.

- Create a family profile

- Search and message candidates directly

- Agree on terms and manage your own contract and payroll

3. Facebook Groups (Budget Option)

Great for families wanting informal arrangements.

- Join groups like Au Pair, Nannies and Babysitters Auckland

- Post your requirements

- Screen responses, interview, and check references

- Finalise with a proper employment agreement

Make It Easy with the Right Support

Hiring an au pair is about more than just childcare it’s about connection, cultural exchange, and creating a welcoming home.

But it’s also a legal employment relationship and getting the payroll right matters.

At Pay The Nanny, we specialise in simplifying the process. From tax and payroll to employment contracts and board & lodging deductions, we help Kiwi families stay compliant, fair, and stress-free.

Need Help?

Email us at: [email protected]

Visit: www.paythenanny.nz

2025 Nanny Pay Guide | Pay The Nanny

Payroll for Au Pairs | Pay The Nanny

Benefits of Hiring an Au Pair in New Zealand

2023 Nanny Pay Rates Guide for New Zealand